CHESLA Employer Student Loan Support (CHESS)

The question is no longer if employers should offer student loan repayment, the question is how quickly can an employer implement a program for their employees. Learn MoreFederal student loans and private student loans are eligible

Permanent

These federal benefits are permanent incentives.

Our CHESS Program!

In this video, our Deputy Director shares an inside look at the CHESS Program — what it is, how it works, and why it’s a game-changer for both employers and employees. Discover how CHESS supports workplace well-being, enhances productivity, and employee retention. Whether you’re an HR leader or a business owner, you’ll see why scheduling a demo could be the smartest move you make. It’s a win-win for everyone involved!

Customize & Implement

- Define eligible employees

- Determine contribution

- Customize communications

- Online portal setup in 1 week

We do the Heavy Lifting

- Manage contributions to loan servicers

- Monthly confirmation sent to employee

- Reports available to view transactions

- Bill employer monthly for employee contributions

Sign Up Employees

- Explain program details to employees

- Provide user friendly dashboard for loan information

- Loan repayment counseling

- Employer approval/employee enrollment activated in portal

Benefits

- Recruitment advantage

- Improve retention and loyalty

- Reduce employee financial stress

- Improve culture & engagement

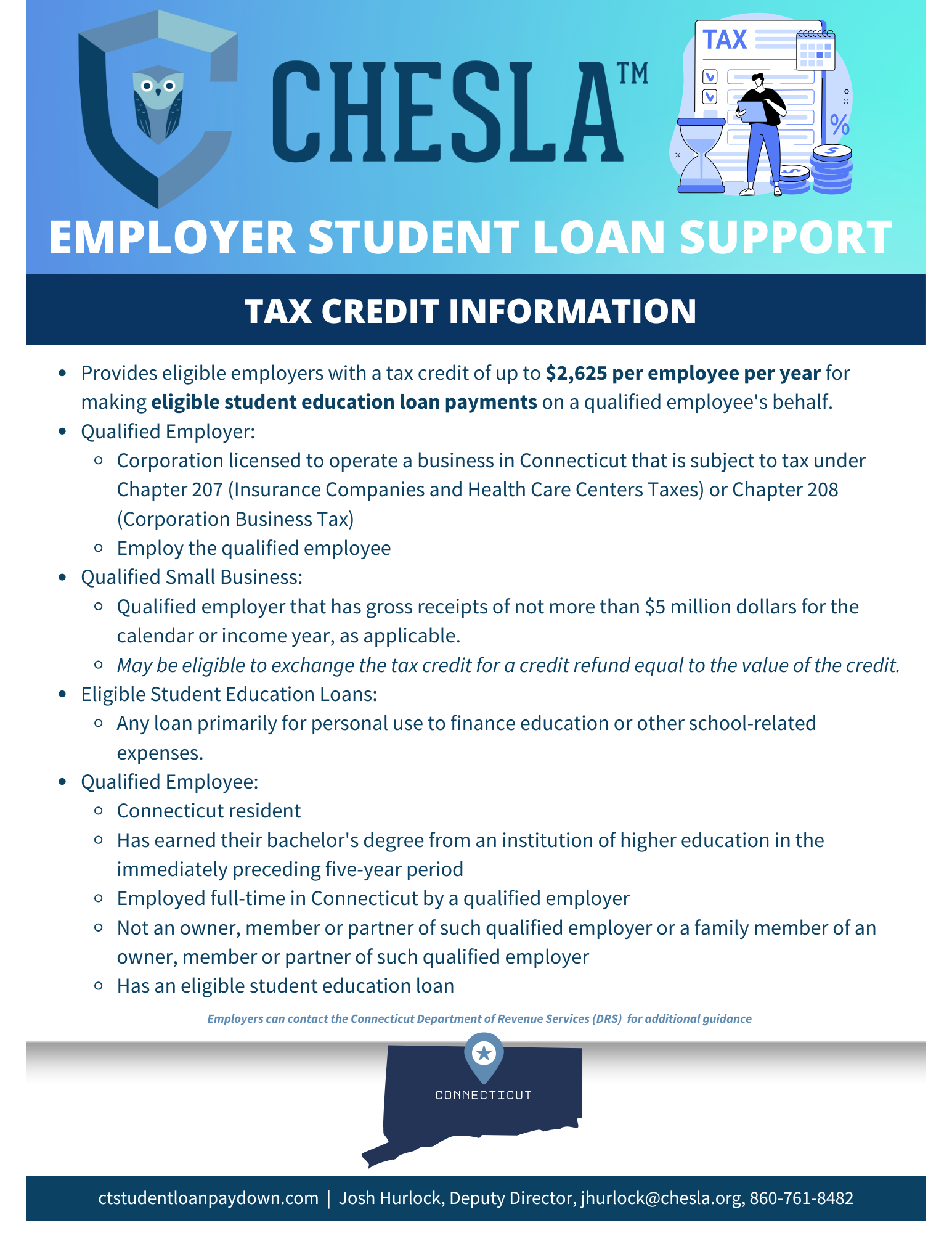

CHESLA Connecticut Tax Credit Information

When you help pay down your employees’ student education loans, your company may qualify for a State of Connecticut tax credit, adding even more value on top of existing federal incentives. The result: a stronger workforce, higher retention, and valuable tax advantages for your business.

Student Loan Benefits on the Rise

The number of employers offering student loan benefits more than tripled in the past five years, from 4% in 2019 to 14% in 2024, according to new data from the International Foundation of Employee Benefit Plans (IFEBP), a non-profit organization with 31,000 employer members.

The CHESLA Employer Student Loan Support (CHESS) program offered jointly by CHESLA and our Rhode Island counterpart, RISLA, offers an easy solution.

%

-American Student Assistance

%

in paying off debt.

-YouGov-Abbott Student Loan Impact Survey